New HM Revenue & Customs (HMRC) data reveals that the nation’s cash ISAs are no longer growing as withdrawals are now matching new contributions.

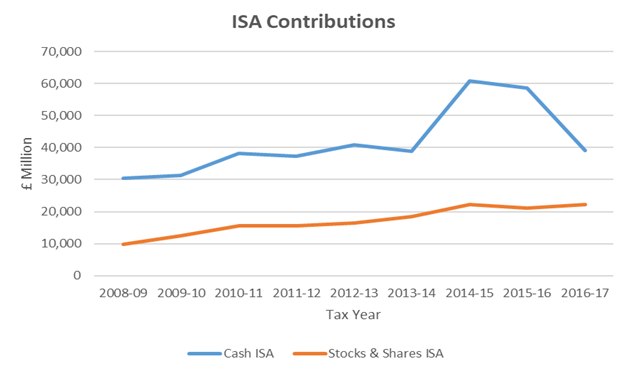

Cash ISAs have traditionally been more popular than investments in stocks and shares ISAs. Recently, this has started to change, as indicated on the most recent HMRC data illustrated in the graph below.

According to the HMRC data, in the last tax year (2016/17), cash ISA contributions fell by a third, falling to around £39 billion (which is still a lot), but the total held in cash ISAs only increased by £1.26 billion in the same period.

If we account for the interest, even at the current low rates, that suggests a net outflow from the nation’s ISA savings.

But there are some good reasons why cash ISAs might be losing favour among savers:

- No real return: ISA interest rates have been low for some time now. The top rates for instant access are just over 1.0%, while the best five year fixed term rate is 2.15%. With inflation currently at 2.9% as measured by the Consumer Price Index, and 3.9%, as measured by the Retail Price Index, there are no real returns to be had by keeping your money in cash.

- No real benefit: The new personal savings allowance (PSA) introduced in the current tax year has meant that many people have no tax to pay on the interest they earn from non-ISA accounts. If you are a basic rate taxpayer, £1,000 of interest is tax free, while if you pay tax at 40%, £500 of interest suffers no tax. If you are an additional rate taxpayer, you do not receive a PSA. With no benefit from the tax-free status of an ISA, why use one?

- For wealthier investors, the reforms to dividend taxation – and the likely reduction in the dividend allowance from £5,000 to £2,000 next April – has made the tax shelter offered for dividends by stocks and shares ISAs relatively more attractive.

- Stock market performance: The UK stockmarket as measured by the FTSE 100 has been at an all time high for some months now, and although this has not received widespread press, it is a factor which encourages people to move their money from savings to investments.

- Personal circumstances: Personal debt in the UK is currently £1.554 trillion. Yes, trillion. It is possible that some savers have been using their money to pay bills or other living costs. (source: http://themoneycharity.org.uk/money-statistics/)

If you hold money in cash ISAs, it may make sense to review whether you should continue to do so. You could find yourself earning more interest outside an ISA or gaining more tax benefits from a stocks and shares ISA.

We can help you review your plans and circumstances.

Call us to discuss your options on 020 8559 2111.

[highlight]The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances. The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax advice.[/highlight]