Despite bad news from every direction, global stockmarkets showed strong rises in the third quarter of 2017. The UK…not so much.

Despite bad news from every direction, global stockmarkets showed strong rises in the third quarter of 2017. The UK…not so much.

If you spend any time at all thinking about the recent news stories to emerge over the last three months, , you might think that there is no good news left in the world. The UK lumbers forward under the cloud of brexit negations, a beleaguered government, and rising inflation.

In the United States, President Trump was again failing to pass legislation while appearing to spend his most productive hours playing golf, or attacking people on Twitter.

In Europe, Angela Merkel won another term as the German leader, but with a weakened majority, signalling that her popularity is waning.

And meanwhile in Japan, Shinzo Abe has called for a snap general election as he tries to exploit the weak opposition. (Let’s hope that works out better for Japan than it did for the UK.)

Meanwhile the US, UK and Eurozone central banks were each in their own way signalling that the days of ultra-easy money are coming to an end, with ‘normalisation’ of interest rates a long term goal.

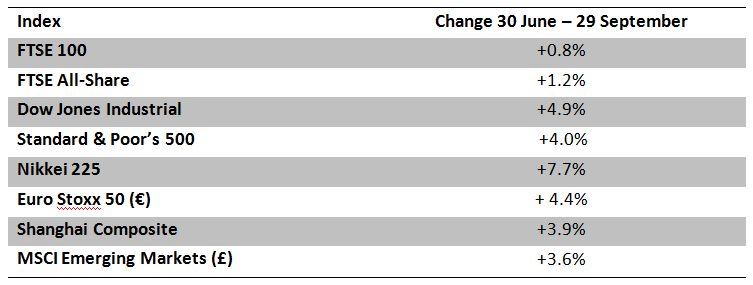

For all that political and financial noise, the main share markets were up over the quarter, a reminder once again that the markets make their own judgements about what’s important in the ebb and flow of news.

But perhaps another thing to take away from this data is the relative movements of the different global indices. The FTSE 100 rose only 0.8% over the period, a fraction of the gains made in China, Japan, Europe, North America and emerging markets.

Over the last decade or so, the UK’s contribution to the global economy has been shrinking, and is likely to continue to shrink. This is not necessarily an indictment of the UK as a place to invest, but rather a reflection of the huge and fast growing markets throughout the rest of the world.

As other markets increase the size of the pie, the proportion made up by the UK will continue to make up a smaller slice.

It’s an important reminder that the investments should be more than the world outside your front door, and that a well diversified portfolio will include a global exposure.

To discuss your own investment portfolio with one of our Chartered financial advisers, give us a call on 020 8559 2111.

[highlight]The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.[/highlight]

Despite bad news from every direction, global stockmarkets showed strong rises in the third quarter of 2017. The UK…not so much.

Despite bad news from every direction, global stockmarkets showed strong rises in the third quarter of 2017. The UK…not so much.