Assessments

You must assess your staff every time you run your payroll. For many firms their staff will be on fixed annual salaries, making this a very straightforward process.

Some employees will be paid hourly, or on zero-hours contracts, or have bonus arrangements which mean it could be months or years before they are assessed to join the pension scheme automatically, so it is important assessments are performed regularly and accurately.

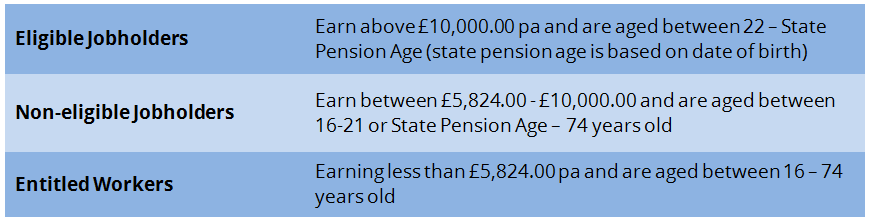

The assessment process will categorise your employees by age and earnings as either Eligible, Non-eligible or Entitled, according to the table below.

These figures are correct as at April 2016 and will be reviewed annually.

- Eligible jobholders will automatically join the scheme and have contributions deducted from their salary. They have the right to opt-out.

- Non-eligible jobholders will have the right to opt-in.

- Entitled workers have a right to join the scheme.

The assessment process can be handled automatically by either your payroll or your pension scheme. In our experience having the assessments performed by your payroll simplifies your duties. Your payroll should be able to produce a contribution summary. This summary can be given to your pension scheme and they can take over from there.

Some payroll systems can communicate directly with a pensions scheme which can reduce your involvement to no more than a couple of extra clicks. See our page on payroll for more information.

Complete our Auto Enrolment Questionnaire and we will tell you how easy this can be.